86 400 → Ubank: Building Trust at Scale

Launched Australia’s first smartbank with award-winning features and scaled to 700K customers and $17B in deposits. Directed customer experience of its $220M acquisition and merger with Ubank, expanding into full-suite digital banking.

Outcomes Achieved

$220M Acquisition

NAB acquired 86 400 for $220M, validating the customer trust and design-led proposition that I embedded through the brand, app and home loan experience.

Award Recognition

Winner of multiple awards, including Good Design Best in Class and Gold for the 86 400 digital channels, recognising innovation in predictive features and digital experience, brand & identity.

From 0 to 700k customers

Scaled the customer base post-merger by embedding design into delivery and maintaining a cadence of new feature releases every three weeks.

Seamless Migration

Directed the ubank brand relaunch and digital migration, ensuring continuity of customer experience through one of Australia’s largest fintech-to-enterprise integrations.

$17B in Deposits

Delivered significant scale in NAB’s digital portfolio through predictive cashflow features and a fully digital home loan, both designed to build customer confidence in managing money.

4.7★ app rating and NPS 51

Carried challenger brand credibility through to enterprise scale by embedding customer insight frameworks and positioning design as a visible strategic capability within ubank

The Challenge

Australia’s 2018 banking scandals created an environment of disruption and consumer distrust, opening space for challengers to prove they could do better. 86 400’s challenge was to anchor every design, brand, and experience decision in trust and speed, showing digital banking could compete with incumbents.

After NAB’s $220M acquisition, the focus shifted to merging with Ubank, expanding from a mobile-only start-up to a full digital bank at enterprise scale while sustaining customer confidence.

The Role

As Head of Design, I was accountable for:

Building and scaling a multidisciplinary design team, tripling size as the organisation grew from start-up to enterprise.

Directing product and experience vision across 86 400 and Ubank.

Embedding design into the product lifecycle and decision-making rhythm from start-up → scale-up → established business.

Lead design execution of the Ubank relaunch across app, web, and digital channels.

What I did

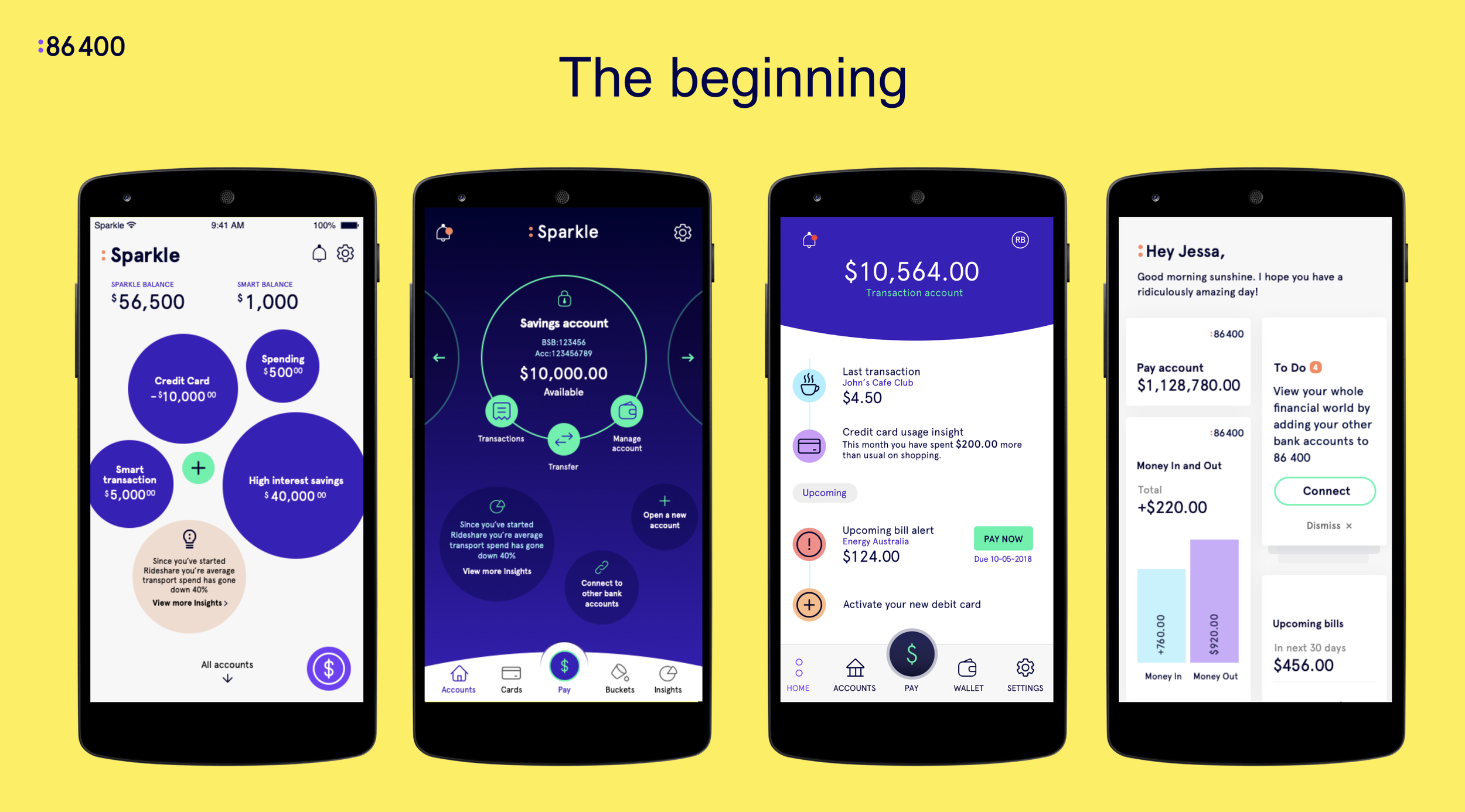

Reset the Build Around Customer Trust

Stopped an early misaligned app build and reframed the proposition to centre on customer trust in a post-scandal market. Secured executive buy-in to scrap and restart delivery, preventing wasted investment and aligning the bank on a clear value proposition.

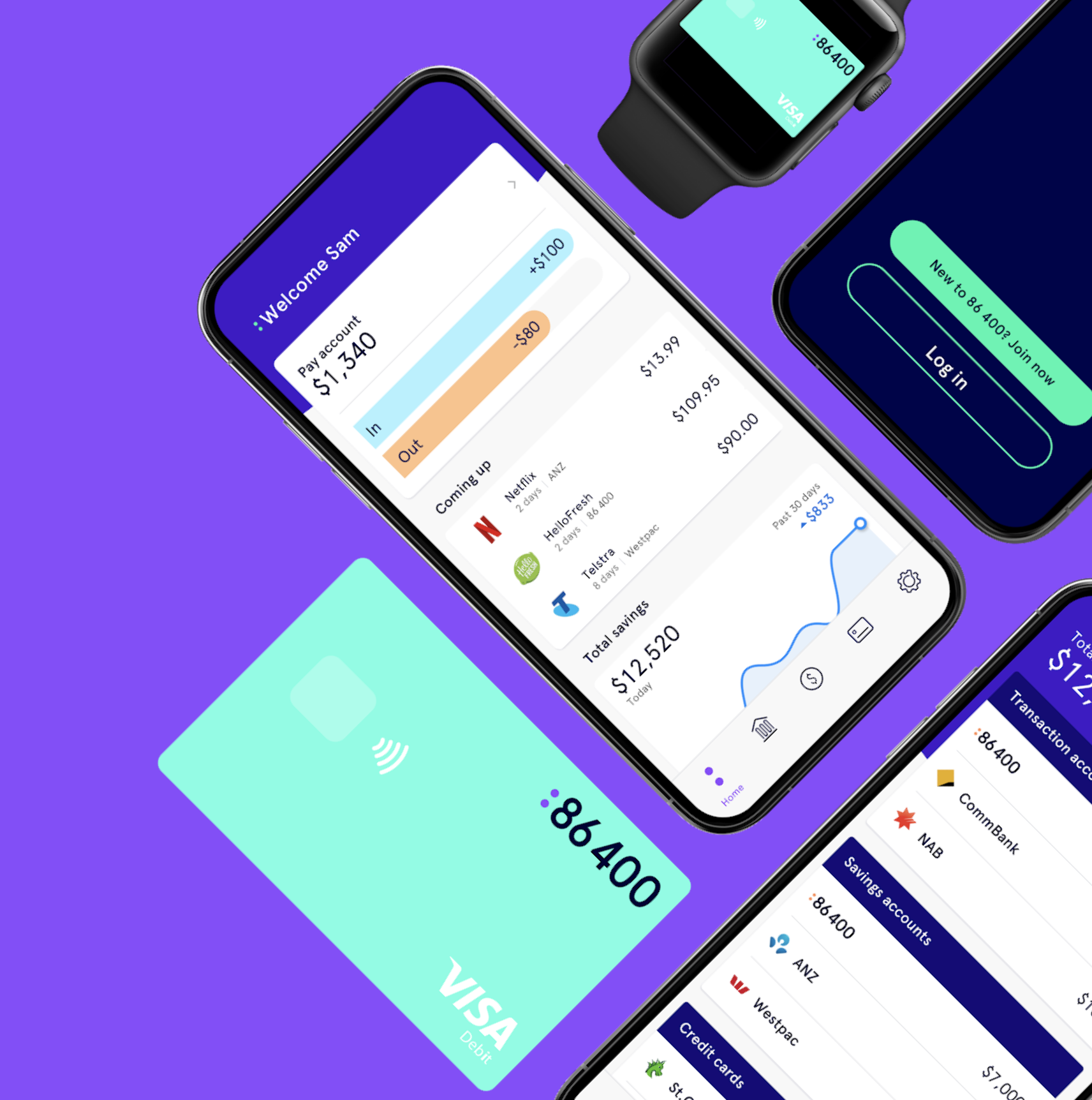

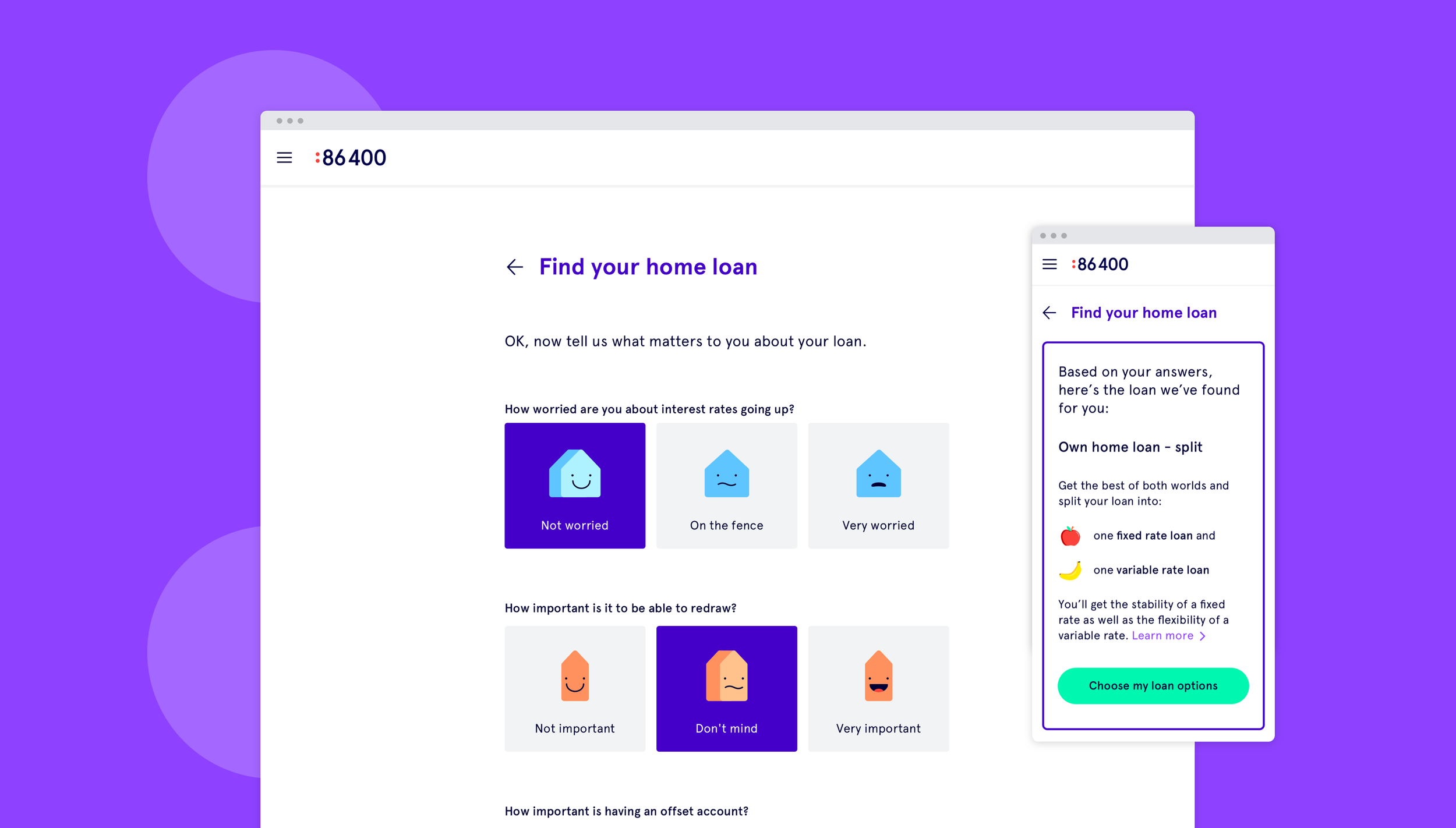

Built Award-Winning App and 100% Digital Home Loan

Directed the design of 86 400’s mobile app and Australia’s first fully digital home loan. Delivered predictive cashflow features that anticipated customer needs, helping the app win Good Design awards and become a category benchmark.

Embedded Design into Rhythm and Delivery

Integrated design into the product operating model alongside product and engineering, embedding rituals and a cadence of new feature releases every three weeks. This established design as a core part of delivery, not an add-on.

Directed Ubank Brand Relaunch

Following NAB’s $220M acquisition, led design execution of Ubank’s new identity across app, website, and digital channels. Ensured continuity of trust and customer experience through a major merger and rebrand.

Applied Customer Insight Frameworks

Introduced Jobs to Be Done, MaxDiff, KANO, and continuous user testing to prioritise and validate features. These frameworks kept customers at the centre of decision-making and gave the business confidence to invest in innovation.

Scaled and Elevated Design’s Role

Tripled the size of the design team and adapted operating frameworks to support enterprise scale. Positioned design as a visible, strategic capability within 86 400 and NAB’s ubank, influencing commercial priorities as well as product experience.